Mobile Banking App -

A Digital Transformation for Financial Services

About the Project

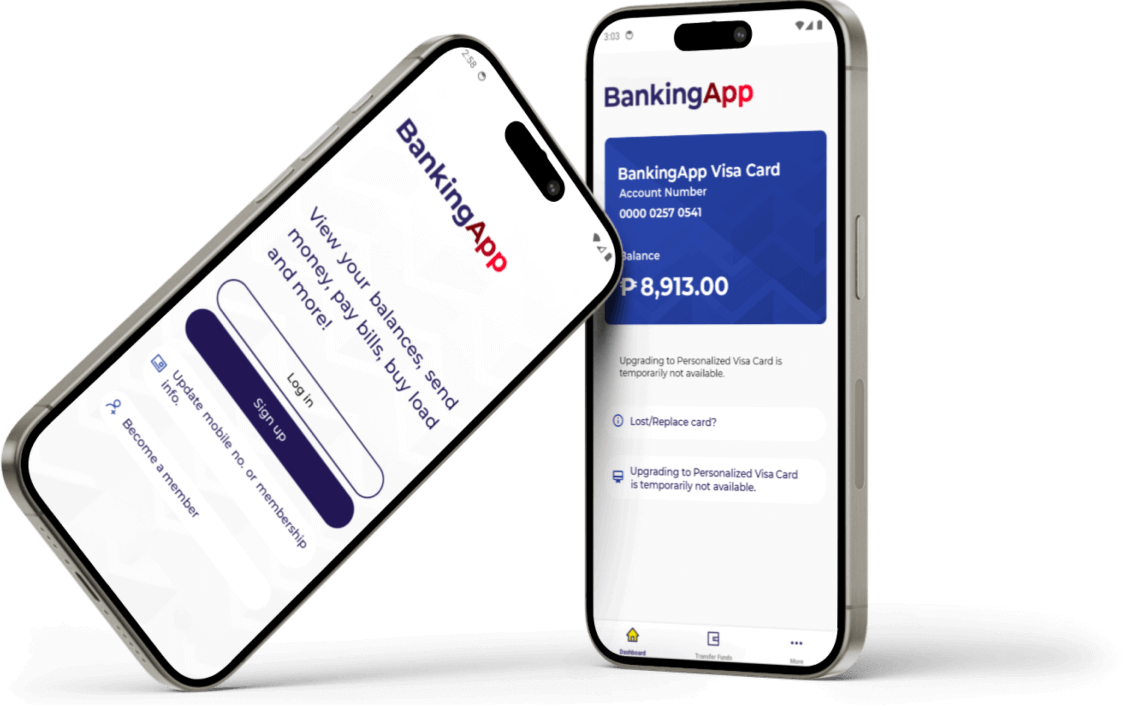

Our client, a financial institution dedicated to serving the needs of a specific community, sought to enhance their digital services by developing a mobile banking app. The goal was to provide a convenient and secure platform for members to access their accounts, conduct transactions, and manage their finances on the go.

Key objectives of the project included:

- Enhanced User Experience: Develop a user-friendly and intuitive app interface.

- Robust Security: Implement advanced security measures to protect user data and transactions.

- Comprehensive Feature Set: Offer a wide range of features, including account management, fund transfers, bill payments, and loan applications.

- Seamless Integration: Integrate the app with the bank’s core banking systems to ensure real-time data and smooth transactions.

- Scalability: Design the app to accommodate future growth and increasing user base.

The Challenges

A leading financial institution sought to create a web and mobile wallet application to serve its members. The wallet required integration with the institution’s internal systems, the banking platform of a partner institution, and it also had to comply with the central bank’s regulations.

Before the introduction of the Mobile Banking App, customers faced several challenges:

- Limited Access to Branches: Physical branches were often inconveniently located, making it difficult to access banking services.

- Time-Consuming Transactions: Traditional banking methods were time-consuming, especially for busy individuals.

- Security Concerns: Concerns about the security of financial transactions, particularly when dealing with sensitive information.

The Solution

We delivered a closed loop web and mobile wallet system that was user-friendly, enabling both members and admins to manage transactions efficiently. The solution streamlined integration with their banking partner, allowing for seamless financial transactions and optimized operational efficiency.

The Mobile Banking App was developed to address these challenges. Key features of the app include:

- Account Management: Users can view their account balances, transaction history, and loan details.

- Fund Transfers: Easy and secure fund transfers between accounts and other banks.

- Bill Payments: Convenient payment of bills, such as utilities and credit card payments.

- Loan Applications: Users can apply for various loans directly through the app.

- Cardless Withdrawal: Withdraw cash from ATMs without a physical card.

- Enhanced Security: Robust security measures, including biometric authentication and encryption, to protect user data.

The Outcome

Leading Membership-Based Financial Institution Serving a Specialized Community

The institution now provides a fully functional wallet system, accessible online and via mobile devices, empowering members to conduct fast, secure financial transactions with their partner banks and vendors, significantly reducing in-office visits, and cutting transaction times by 50%.

The launch of the Mobile Banking App has significantly improved the financial experience of customers:

- Increased Accessibility: Users can access their accounts and conduct transactions anytime, anywhere, through their smartphones.

- Time-Efficient Transactions: Digital banking has streamlined processes, saving users valuable time.

- Enhanced Security: Robust security measures have instilled confidence in the app’s users.

- Improved Financial Literacy: The app has promoted financial literacy by providing easy-to-understand information and tools.

- Positive Impact on Financial Well-being: By simplifying financial management, the app has contributed to the overall financial well-being of users.

The Mobile Banking App has successfully transformed the way customers manage their finances, providing them with a convenient, secure, and efficient digital banking solution.

Technologies

Web, Mobile

JavaScript, TypeScript

Web: React, Express.js

Mobile: React Native, Express.js

MySQL

Figma